The problem then becomes taxes.

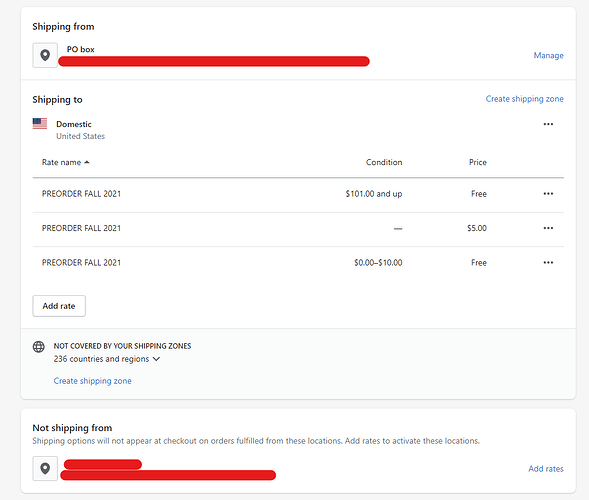

This will change the return address, but then taxes will be calculated from the po box address. Since that is not the warehouse or office, it is not the legal nexus and cannot legally be the address where taxes are calculated from. This is the issue I’m having right not with Shopify.

Taxes and shipping have to become two separate address inputs for home based businesses to maintain privacy. I am amazed this is not available. For e-commerce retail, the taxes are calculated based on the customer location in relation to the business nexus.

If the address in Shopify is not the nexus (home owner in this case), then tax calculations will be wrong, regardless. Is there a work around? Shopify desperately needs to allow account owners to specify: nexus address, return shipping address, and ship from zip code.

My home is my nexus. My UPS personal mailbox (in the next town and county) is my public company physical return address, and I ship from the closest USPS to my home, which is in my zip code but NOT in the same county or city jurisdiction as my nexus (home) and not the same zip code as the UPS personal mailbox for businesses.

This is the best available options for me, because there is nothing in the same tax zone as my home, and many public legal filings will not accept a PO Box location. Anyone who does not live in a big city where there home is also the same jurisdictions as there anonymous mailbox (PO or PMB), is most likely running in to this same issue. Many probably don’t realize.

I realized because Shopify charged taxes for some customers who lived in another county and city (where my UPS PMB was) and I realized it was because I had made that my ship from address so the return address in the shipping label would be correct. But that is not where I ship from and it is certainly not my legal nexus for taxes. It is simply an anonymous public address for returns and correspondence. That’s it.

It’s a simple fix on Shopify end, but a major difficulty for us. I am forced to choose whether to let everyone know my home address OR have my Shopify taxes be correct. This is a ridiculous choice to have to make in order to use Shopify.

The ship FROM zip code is a USPS tracker and also needs to be manually correctable, because the ship from zip code is how USPS tracks the route needed for the package. According to my post master, shipping from a different zip code can cause a longer ship time because it can cause the package to be sent first to that zip code distribution center before being sent to its destination. Causing an extended route.

We need 3 entries with manual input for Shopify to populate labels and taxes from.

-

business nexus address (private- office presence, warehouse, for sales tax calculations)

-

return address (public- for shipping labels and any public notification to customers- packing slips, details on credit card purchase, etc.)

-

the ship from zip code for USPS tracking. (This populates on the shipping label, upper right, under package weight and is used by USPS for tracking.)

These options are available on other platforms. All it would take to build out is the input form in our settings, and that input be directed to the appropriate places already in the system for labels, taxes, etc. It’s a simple form change and re-route.

This is a huge problem for a home based business in a rural area and many owners are probably not aware. Please correct this. This is privacy and taxes. It is not something that should be left alone or wait for a certain amount of complaints before correcting. It was hard for me to figure out what was happening and I’ve seen MULTIPLE online questions being asked that relate to this. Just like this question. If anyone is asking about their return address being different from home address, then this is most likely the same problem for them. They may just not have realized the tax implications yet or they’re lucky their PO or PMB are in the same jurisdictions as their home.