As much as Shopify Tax advertises itself as being accurate, it’s not. ![]() I have a craft fair this weekend and when I test it in POS, it is charging the wrong tax rate. Here is the workaround I managed to figure out. (I am in Colorado):

I have a craft fair this weekend and when I test it in POS, it is charging the wrong tax rate. Here is the workaround I managed to figure out. (I am in Colorado):

Step 1 : In settings, under Locations, rather than deal with multiple locations/inventory, just change the location to the event location. Test POS to see if Shopify is charging the right local tax rates. Tax lookup tool for Colorado: https://colorado.ttr.services/

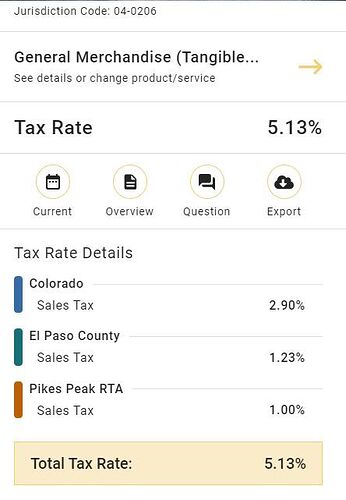

Colorado tax rate for 1300 Higby Road, Monument, CO, 80132 (it’s inside a high school) according to Colorado tax authorities:

Here is what Shopify POS is charging in taxes, which is clearly WRONG. It’s charging 3.5% Monument tax, which is incorrect (no tax on school property - confirmed with Colorado as well as the event organizer), and it’s not charging the 1% PPRTA tax, which it should be - so it’s charging 2.5% extra. And maybe this doesn’t seem like a big deal as I could collect and report as excess tax collected, but the minute a customer notices and says anything, it IS a big deal. Not okay.

Continuing with temporary workaround…

Step 2: If tax rates for the event are wrong, create a MANUAL collection. Make it only available on POS (people online don’t need to see it), and add ALL Products to it using the bulk edit tool. (It has to be manual - this only works for manual collections.) I just name it “Tax Override” so I know what it is.

Step 3: Set up tax override. Go under Settings → Taxes and Duties → United States → Product Overrides. Click on “Add product override”. Find the “Tax Override” collection created earlier, and select that. Enter the correct TOTAL tax rate for the location. There will no longer be a breakdown in the POS, but as long as the total rate is correct, customers aren’t over or undercharged and sales taxes can be filed.

Step 4: There is no way to remove the tax override, so after the event, you have to go back and just delete the tax override collection. Remember to test before and after the event.

The problem with my workaround is that it impacts ALL sales inside Colorado, so during my event, if anyone from Colorado buys something online, the tax rate will be wrong, because Colorado has destination sourcing and the taxes are based on where the purchaser lives for online sales, or where the event is for in-person sales. This is so frustrating. If Shopify would ONLY apply the tax override to sales made via POS, I wouldn’t have this issue and my workaround would work just fine. I guess I could take down all my products in the online store during the event, but I don’t want to do that as most of my online sales are out of state anyway and aren’t taxed. So instead, I will apply the override to charge the correct amount at the event, and if anyone within Colorado buys during the event, I will cancel their order with an explanation/apology and let them reorder if they want after I’ve reverted the taxes back.

Hey Shopify, can y’all PLEASE fix this? ![]()