Hello,

We are recently switching from WooCommerce to Shopify and have an issue in the tax calculation. Somehow, we cannot find the right option to replicate the correct VAT behaviour in Shopify. I’ll explain the issue: Among others, we sell products with reduced VAT rates (food productes for examples) from our home country Germany and other EU countries. So while the standard VAT rate in Germany might be 19% and in Austria 20%, for food items its 7% in Germany and 10% in Austria. The correct tax calculation as it currently works in WooCommerce is the following:

Germany:

Food Product A

21,95 €

contains 1,44€ VAT at 7%

Austria

Food Product A

22,56€

contains 2,05€ reduced VAT at 10%

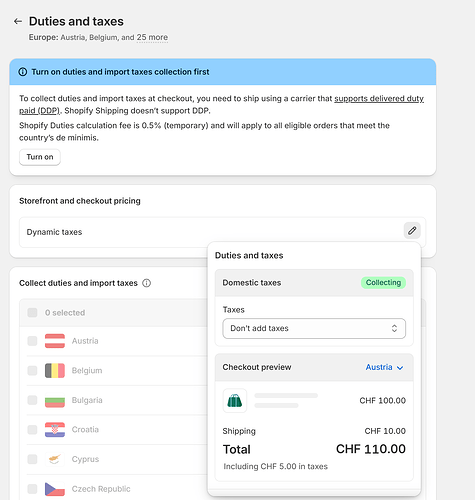

In Shopify, we created tax overwrites to get the correct rate: 7% for food collection in Germany, 10% in Austria. We have tried all different combinations of tax and market settings. The closed we get is with dynamic tax inclusion enabled. This is the result:

Germany

Food Product A

21,95 €

contains 1,44€ VAT at 7% (absolutely correct)

Austria:

Food Product A

22,14 €

contains 2,01 VAT

What I think happens is: Shopify (although it shows the correct VAT in Germany, which is weird) calculates like this for Austria:

21,95 € - 19% German VAT (Wrong) + 10% Austrian VAT

However, what it should do is this (and btw, shopifys documentation says it does):

21,95€ - 7% German VAT + 10% Austrian VAT

Does somebody has an answer to this? We can’t be the only EU store to experience this issue.

Thanks in Advance.