Here we go again this year… @Shopify_77 decides to fail to issue 1099-K forms and claims they received an extension until the END OF FEBRUARY!!!

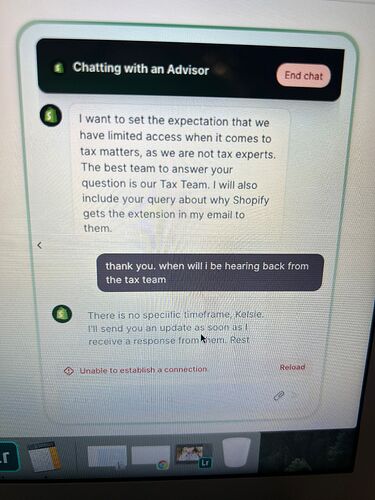

See below my chat with them. Absolutely proposterous. As an S-Corp, I must file by March 15th. This gives me little to no leeway to prepare our taxes.

After 15 minutes in the line…

ME: How much longer???

SHOPIFY: I’m sorry for the wait. I know your time is valuable. I don’t have an exact time, but I assure you that a Support Advisor will be with you as soon as possible. In the meantime, feel free to ask me any other questions you might have about Shopify. I’m here to help!

SHOPIFY: An advisor has joined the chat

**SHOPIFY:**My name’s Caleb, your Shopify Support Advisor!

ME: Where is my 1099-k?

ME: It’s past the deadline to issue them per US IRS guidelines.

SHOPIFY: Hey Rick! Hope you’re doing well.

ME: Not really.

SHOPIFY: The 1099-K’s for 2023 are not yet available. Typically, 1099-K forms for transactions processed in the previous calendar year are due to be delivered to merchants on or before January 31st as you have mentioned. However, Shopify has obtained a filing and delivery extension. As a result, we expect to deliver the 2023 1099-K forms to merchants by the end of February 2024. On a side note, to be eligible for the 1099-K form, you need to have more than 200 transactions and more than $20,000 USD in gross payments during the calendar year.

ME: I’m having to delay tax preparations

ME: That’s unacceptable.

ME: I would like to see a formal letter of issue from the IRS stating this.

ME: I am VERY eligible.

ME: My taxes are due March 15 as a corporation and a delay is not possible.

ME: Hello?

ME: I am not a simple LLC and I MUST file by March 15th. The timing you have proposed will not allow adequate time to prep.

ME: Are you still on?

SHOPIFY: I do understand you’re looking to meet the deadline. I am just going to confirm if we have a formal letter or not.

SHOPIFY: I’ve confirmed we don’t have a formal letter to provide you, but the information I provided about the extension is accurate.

ME: Then how am I to believe this?

ME: This is a MAJOR issue that you’re causing MY BUSINESS and will have MAJOR repercussions for ME.

SHOPIFY: I hear that this isn’t ideal for your circumstances however the 1099-k forms are looking to be delivered by the end of February.

ME: It’s not about being ideal. It’s a LAW to file by a date and if I miss it I SUFFER the consequences. YOU all are causing the issue.

ME: End of Feb is not acceptable.

ME: Please pass me to a supervisor.

SHOPIFY - THEY NEVER RESPONDED