This error is going on for 6 months and Shopify support just promised to fix it, but nothing happens.

Problem explained from customer perspective in 3 steps with screenshots:

-

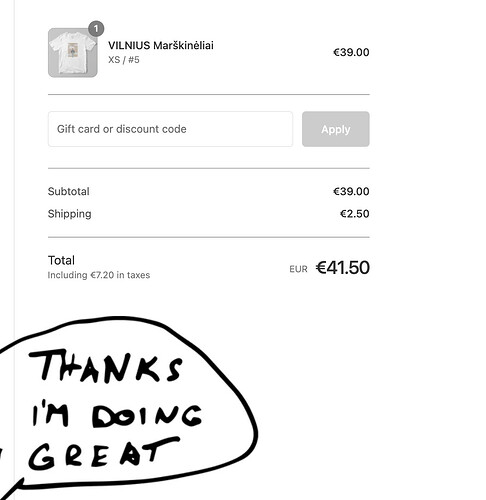

Tshirt cost 39 EUR (with 21% VAT), 32.23 EUR (without VAT) and I want to give a 38.99 Eur Discount to my customer.

-

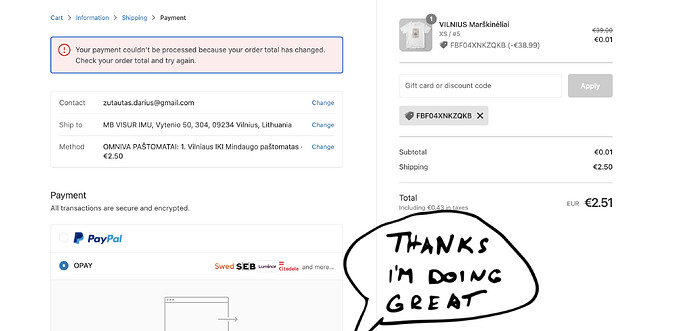

Customer adds discount code which gives 38.99 EUR discount, So item should cost 0.01 EUR , but problem is that system starts calculating discount from price without VAT and Tshirt goes for free.

-

And at the last checkout stage, the discount is being calculated from the price with VAT, so the Total amount does not match and the system gives an error message.

I’m very disappointed that Shopify can’t solve problem for the last 6 months. Im a bit tired of those answers “technical team is still working” “we found a problem and fixing it” or the last few emails they just stoped answering ![]()

Any help would be great

Screenshots of order steps