I’m in the UK and just testing out Shopify for the first time. I’d rather not go through the hassle of opening a business before getting a sale on Shopify.

Mainly because if I don’t get any sales then I’d have opened the business for nothing.

However, I’ve read online that once you get your first sale, Shopify put it on hold and ask for business documents?

In that case what does a fella like me do?

Hi @Adamseptember ,

Thank you for getting in touch. If you decide to use Shopify Payments in the UK, you will be asked to provide certain information when signing up which is used for verification purposes. This is standard procedure for payment gateways. You may also be required to provide additional information once you have started selling and are receiving orders.

In these cases, your payouts may temporarily be put on hold until any requested documents are provided and reviewed. If you provide them shortly after being asked to, the hold is typically lifted pretty quickly and you will receive your payouts on a normal schedule again. You can read more about this in section B-3 of the Shopify Payments UK Terms of Service.

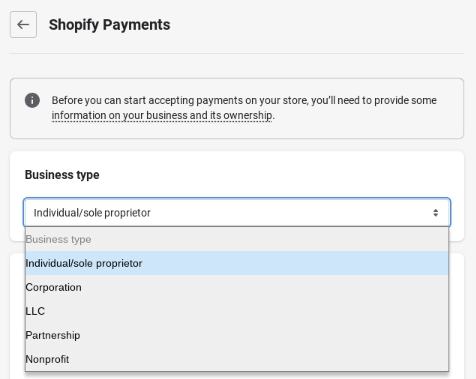

You are able to use Shopify Payments in the UK as a sole proprieter and register as an individual rather than as a registered business, so you do not need to register your business before using Shopify Payments. You will be given the option to outline your business type when setting up Shopify Payments:

I would recommend using Shopify Payments in the UK, as you will not be required to pay transaction fees for payments processed using the gateway, and you can also use it to accept payments via accelerated checkouts such as Apple Pay and Google Pay. You can also use the gateway to accept payments in multiple currencies if you are planning on selling your products abroad.

I hope this helps but please let me know if you have any further questions.

Hi Adam,

Great question — you’re not alone!

If you’re in the UK and just testing Shopify, you don’t need to register a business (like a UK LTD) immediately to start building your store. However, once you start taking payments, especially using Shopify Payments, Shopify will likely ask for identity and business verification.

If you’re unable to use Shopify Payments due to your business model, product type (such as CBD, vapes, supplements, etc.), or residency status, WallidPay is a strong and professional alternative to consider.

Why WallidPay?- High-Risk Product Support: WallidPay is specifically built to support industries commonly rejected by traditional processors—CBD, hemp, wellness, vape, nootropics, adult health, and more.

-

UK LTD & Non-Resident Friendly: Even if you’re operating your business from outside the UK, as long as you have a UK-registered entity, WallidPay can work with you.

-

Smooth Shopify Integration: WallidPay is available on the Shopify App Store and offers seamless setup and onboarding.

-

Faster Payouts: Unlike Shopify Payments, which often have delayed withdrawal schedules, WallidPay offers instant or faster withdrawals, helping you keep better control over cash flow.

-

Clear Documentation & Real Support: WallidPay accepts common UK business documents (like utility bills, company registration, or ID from your country), and their support team is responsive and focused on helping merchants succeed.

Official Website: https://wallid.co

Shopify App: WallidPay on Shopify

Whether you’re dropshipping, selling regulated products, or operating from outside the UK, WallidPay is a dependable solution for keeping your store live and converting sales without compromise